I noticed an introduction on xueqiue about GVAL ETF the other day. I got intrigued by its strategy and had a look. Its issued Cambria is run by Meb Faber, who runs the podcast on iTunes and quite well-known among investors. I watched his interview with Ed Thorp before. It is a good one.

Roughly speaking the fund’s strategy is to value the countries or regions by Shiller 10 year CAPE ratio and pick the bottom 25% as the universe, and then select the top 30 stocks by the market cap and filter them further by traditional P/E, P/B, P/FCF, EV/EBITDA etc. The final picks are about 100 stocks and rebalance the portfolio every year. For the detail, you could check the prospectus

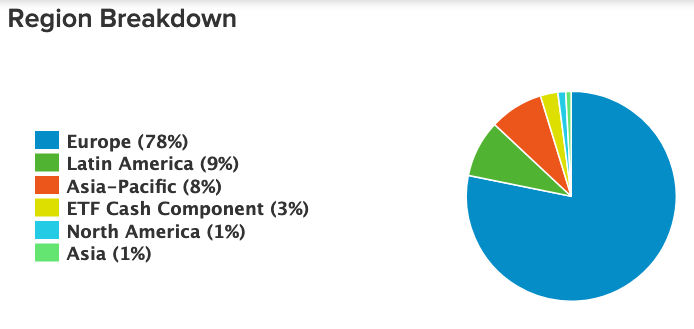

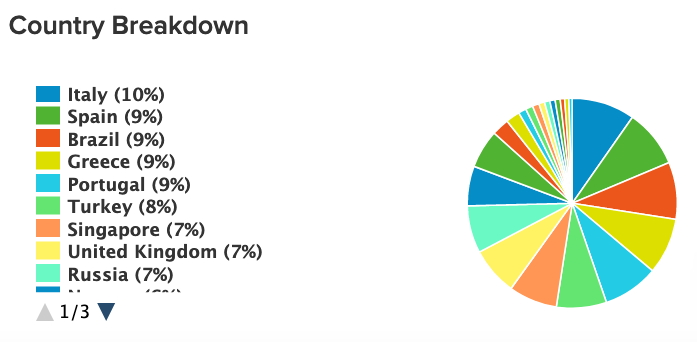

And the pie chart for the regions and countries like this.

Since fund’s introduction mentioned Graham and Dodds. I couldn’t help to link that with Graham’s net-net strategy, to use a bag of extremely low value to bet it statistically would “somehow” reverse to the mean. I know Graham in general encourage to hold it for 3 years, if nothing happen then sell it. However, seeing the fund’s underperformance in the last two years, I couldn’t help to list a few of the reasons that may not happen.

- Country suffers longer than individual company from the structural reason. You could insert new management or somehow an earning quarter activate the hidden value. But country’s policy move slower. New bill need to be passed, and cabinet need to be formed in any of democratic regimes.

- Comparing to the companies in the same currency zone, the international flow of the money is decided by too many factors. If the money not flowing in those countries then the value wouldn’t recover. There has to be some reason to flow in, and merely undervalue may not be a strong enough reason.

I tried to make another list by the data compiled by Damodaran. I removed the countries that has too few stocks listed, and sorted the list by from high to low by ROIC, then ROE. and low to high by EV/EBIT. The reason to make this sorting is that I think marginal investment return would be a stronger reason to attract the money to flow in, but not simply low value. The list is like the following:

| country |

|---|

| Thailand |

| Finland |

| China |

| Singapore |

| Denmark |

| Japan |

| Hong Kong |

| South Africa |

| Taiwan |

| Bangladesh |

| Vietnam |

| United Arab Emirates |

| Argentina |

| Italy |

| Nigeria |

| Jordan |

| Netherlands |

| Russia |

| Mexico |

| Switzerland |

| Romania |

| Turkey |

| Sri Lanka |

| Egypt |

| Oman |

For the top 20 there are some overlaps, but the rankings that was in the low Shiller 10 year CAPE are ranked lower. This ranking somehow matches with some of my private findings of good value company globally. I would argue this ranking should be a relative good pool to fish. But not the simply low multiple ranking. With that said, I didn’t do thorough research to do back-testing etc. It’s simply my hunch though.

This is just a rundown of my thoughts, not a rigorous research.